Newsletters

Establishing a Clinic Relationship

Chances are your organization has a process for making significant purchases. But does that process include medical care for injured employees? Probably not. Without guidance, your injured employees may seek care from their family doctors or other general practitioners. However, these care providers may not be optimally qualified to treat occupational injuries. By partnering with an appropriate medical provider, you can improve an injured employee’s access to occupational health care and enhance the effectiveness of their treatments. You can also reduce you workers’ compensation costs by returning employees to work as soon as possible. Choosing the Right Provider

Relying on the credentialing process of your group health network may not be enough to assure your employees are receiving the best occupational medical care. Just because a provider is credentialed through a network doesn’t mean they are best qualified to treat workplace injuries. Without a pre-arranged plan, your employee may end up with a medical provider who does not give adequate consideration to a work-focused physical examination. You want a provider who will establish causation for the injury and develop a treatment plan to achieve maximum medical improvement in the shortest period of time. The key is to recognize the important differences between the occupational health delivery system and the general medical community. Your company needs to find and partner with medical providers whose core practice areas are occupational health delivery and injury management. Their mission and vision need to support your goals of keeping employees safe, healthy and on the job. Early Return to Work In recent years, the frequency of workers’ compensation claims has declined, yet workers’ compensation costs continue to climb. Medical, lost time and other claim costs continue to trend higher despite employer safety initiatives and persistent government efforts at policy reform. Partnering with the right medical provider is one way to combat this trend. Study after study has shown that workers who return to work within three or four days are much less likely to file lost time claims than those with longer absences. Providers who understand this important dynamic and who make prompt recommendations for returning employees to work with any appropriate restrictions are your primary allies in keeping claim costs down.

Your relationship with medical providers will help you control costs in several specific ways – some of which may not be obvious:

- Employees will return to work sooner, thus keeping the claim “medical only” in many cases. Medical only classification rules vary by state, but this has a significant impact on the workers’ compensation experience modification factor.

- The medical-related costs of the claim will be reduced because the treatment plan is more effective.

- The indemnity-related costs of the claim (the payments associated with lost time) will be reduced because the treatment plan results in the employee returning to work sooner, either full or modified duty.

- Your employees will be more likely to approach an approved occupational medical provider with a positive attitude and expectations. This decreases the potential for a “malingering” claim and potential litigation.

Implementation Developing a relationship with the proper provider may seem daunting, but with a little forethought you will be able to build a successful relationship that will have continued benefits. To begin: Develop a contact list of medical providers: Once you have your list, contact the providers by phone. Get the names of the medical director, clinic director, business manager or clinic marketing staff. Don’t be intimidated by communicating with medical professionals. Most clinics are eager for new business and will be more than willing to discuss options with you. Qualify Providers: The purpose of your visit to the provider is two-fold: you want to share more information about your company, its operations and its Return to Work program goals, and you want to learn if this provider will meet those goals. It is good business practice to qualify medical services vendors the same way you would qualify the vendors of any other important products or services your business needs. In your discussions with a clinic, be clear that your focus is not to negotiate a deeply discounted fee schedule. Instead, communicate that you are offering to provide regular business to the clinic in exchange for their commitment to certain requirements. Execute Performance Agreements Between Selected Providers and Your Organization:

Once you have conducted your evaluation of the clinics and selected the one(s) that best suit your needs, it’s time to execute clinic and employer performance agreements to define your mutual expectations. These non-binding agreements are simply a reminder to all parties of the objectives of the relationship. You may need to negotiate the finer details, but the general purpose of the agreement should be acceptable to the majority of practices. Execute Return to Work Agreements with Employees: After clinic and employer agreements have been completed, you should execute a return to work agreement with your employees. State law will determine the level of autonomy your employees have when choosing a provider. However, this agreement helps ensure that your employees are informed of the relationship your company has in place with medical providers. It is important for employees to understand that these providers were selected because they are well-qualified to serve injured workers and the return to work process. Even if you are in a state where employees can select any physician, this agreement will still alert them to the distinction between occupational health medicine and general industry medicine. Monitor Performance: With a strong clinic relationship, you can expect to see improvements in several measurable aspects of the return to work process. Look for:

- A decrease in the percentage of off-duty workers

- A decrease in the number of lost workdays

- A decrease in the indemnity portion of losses

- A decrease in the number of injuries exceeding expected disability duration

If you are not observing improvements, discuss the data with the clinic to determine whether process changes can improve the analytical measures. The following resources are available to you through your Loomis Company representative:

- Contacting a Medical Provider(phone script)

- Contacting a Medical Provider(sample letter)

- Medical Clinic Policy(sample policy)

If you have additional questions or need assistance, please contact: Diane L. Cameron, Director of Claims Office (610)374-4040 ext. 2318 Mobile (610)413-3191

The Work Comp Insights is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice. © 2011 Zywave Inc. All rights reserved.

Fighting Fraud with Special Investigation Units

Fraudulent workers’ compensation claims are estimated to cost employers several billion dollars annually. Ranging from employees squeezing a few extra days off work to completely fabricated injuries, fraudulent claims can increase your premium costs and negatively influence your bottom line. To reduce costs associated with fraudulent claims, it is important you know how to detect signs of fraudulent activity. While you may not be an expert at fraud detection, there are resources you can turn to when you have reason to doubt the legitimacy of a claim. Special Investigation Units

Many insurers have Special Investigation Units (SIU) that are experienced in exposing fraud. Insurers recognize that while the average employer may be able to recognize some signs of a possible fraudulent claim, they may not have the resources or training to successfully investigate the situation. When you suspect the legitimacy of a claim, an SIU can investigate, drawing on a wealth of experience and resources to discover and document any fraudulent activity that has occurred. While large insurers often employ their own in-house SIUs, many smaller insurers use groups like the National Insurance Crime Bureau (NICB), whose purpose is to identify and stop fraudulent insurance activity, as their SIU. Discovering Fraud While SIUs are always on the lookout for fraudulent activity, tips from employers are very important and can turn them on to potential cases of fraud that otherwise might have been missed. It is important that you keep an eye out for signs of fraud and alert your insurer’s SIU when you find them. The following may be a red flag for fraudulent activity:

- The injury is not reported promptly

- The injury does not fit with the typical duties performed by the employee

- The employee’s account of injury differs from witness accounts

- There are no witnesses to the injury

- Medical treatment seems excessive or lengthy for the type of injury

- Employee regularly misses medical appointments

Do Your Part to Eliminate Fraud

While SIUs are there to help, not everything can be left up to them. It is important that you take proactive measures to eliminate fraudulent activity before it requires the attention of an SIU. Strong workplace safety programs make it harder for dishonest employees to fabricate workplace injuries. Also, set strict injury reporting guidelines so you can monitor the claim from the onset. Finally, whether it is discovered by you or by an SIU, vigorously prosecute all fraud-related cases. It is important to show that your organization will not tolerate any abuse of the workers’ compensation system. Types of Fraud

An employee commits fraud by knowingly and intentionally receiving wages while collecting total disability benefits or receiving partial disability benefits in excess of the amount permitted while receiving wages. One thing to keep in mind is that employees are not the only ones subject to prosecution for fraud. An employer commits fraud by understating payroll or misclassifying employee job codes in order to reduce premiums, thus making it difficult for the honest employer to compete in the marketplace. Medical providers and attorneys may also engage in fraudulent activities by overbilling and improper coding for services rendered.Reporting Fraud Anyone who commits fraud may be subject to civil or criminal penalties. Reports of workers’ compensation fraud should be directed to the Office of the Attorney General by either calling 717-787-0272 or visiting their web site (www.attorneygeneral.gov) for access to an online complaint form. If you have additional questions regarding fraud detection, investigation or reporting, you can contact your Loomis Company representative for further assistance.

If you have additional questions or need assistance, please contact: Diane L. Cameron, Director of Claims Office (610)374-4040 ext. 2318 Mobile (610)413-3191

The Work Comp Insights is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice. © 2011 Zywave Inc. All rights reserved.

When an Employee Refuses Workers’ Compensation Treatment

Based on the geographic location of your business, many state workers’ compensation statutes limit and mandate certain employer actions when a worker is injured. Depending on the state, there are specific timelines to follow and forms to complete. But what about when a worker is injured and refuses to accept treatment or file a claim? What are your responsibilities? While the exact legal answer depends on your situation and state laws, consider the following to limit your liability.

When You Notice If you notice that an employee has been injured, even if the employee has not mentioned it, gently bring it up and discuss the circumstances of the injury with the employee to determine whether the injury is job-related. Many state workers’ compensation statutes obligate employers to report injuries as soon as they have knowledge of them. Delay in reporting the injury could result in much more costly claims. Completing the paperwork to report injuries is not an admission of your liability – on the contrary, it could protect you. In the Case of Refusal When you do discuss the injury with the employee, explain that reporting job-related injuries entitles the injured worker to certain benefits while recovering from the injury. If the employee does not wish to file a claim for the injury, file the employer’s portion of the report with a statement of refusal to pursue a claim signed by the employee. It is crucial that you document this conversation to protect your organization from being penalized in the future. Employees that do initially report injuries but then refuse treatment by the physician or facility that your organization furnishes, should sign a similar form confirming this refusal.

Benefits for Employees That Refuse Treatment State workers’ compensation statutes vary, but in most cases, workers’ compensation benefits are suspended for employees that refuse to comply with any reasonable request for examination or refuse to accept medical service or physical rehabilitation which the employer elects to furnish. Benefits may not be payable for this period of refusal of treatment – check with your workers’ compensation carrier. What to Do Now It is important that you prepare for an eventual employee refusal to submit a claim or refusal to accept treatment for a workplace injury. All employers should have a legal representative draft a form for refusal of treatment that complies with state requirements so it is immediately available when needed. Discuss with supervisors the importance of documenting and reporting all injuries, whether or not the worker chooses to report them. Workers compensation insurance is obligatory in most states. If you have questions regarding reporting requirements specific to any state in which you are doing business, contact legal counsel or your Loomis Company representative.

If you have additional questions or need assistance, please contact: Diane L. Cameron, Director of Claims Office (610)374-4040 ext. 2318 Mobile (610)413-3191

The Work Comp Insights is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice. © 2011 Zywave Inc. All rights reserved.

How Not to Hire Your Next Workers’ Compensation Claim

Selecting the right employee is never easy when browsing through numerous resumes, looking for the best candidate. Even if a candidate has successfully completed the initial hiring process, and a job offer is made, it should be made in the form of a conditional offer of employment. According to the Bureau of Labor and Statistics, 13 percent of all work place injuries occur within 90 days of hire. Of that 13 percent, nearly one quarter of those injuries occur within the first four hours on the job. By understanding and implementing the procedures we are about to discuss, you can play an active part in reducing injuries in the work place. Workers’ Compensation & The ADA Due to pre-existing medical conditions or limitations, some potential job candidates may be more prone to work place injuries. It is a common misconception that the Americans With Disabilities Act (ADA) prevents employers from asking any medical questions during the hiring process. However, according to the Department of Labor, there are actually three stages of employment – pre-employment, post-offer but pre-placement (after the conditional offer of employment), and employment. During the first and third stages, it is true that you cannot ask any medical questions. However, during the second phase, after a conditional offer of employment is extended, you can ask the applicant to fill out a medical questionnaire and/or submit to a medical examination. If, in medical opinion, the applicant is unfit for the job, you can withdraw the offer. It’s that simple. To avoid hiring your next workers’ compensation claim, there are two key processes that you will need to implement.

The Conditional Offer of Employment

The ADA says that employers cannot require a job applicant to provide medical information or undergo a medical exam until a conditional offer of employment is made. When a conditional offer is made, you are essentially hiring the candidate. However, the employment is conditioned upon the candidate being physically able to perform the essential job duties of the position with reasonable accommodations for any physical or mental disability. The only way an offer may be withdrawn prior to the effective date of employment is if, in medical opinion, the candidate will be unable to perform the job duties safely with reasonable accommodations. If reasonable accommodations can be made, you must make them.

The Medical Questionnaire/Exam

After you extend a conditional offer of employment, it is time to perform a medical screening of the candidate. Keep in mind that you can only require a candidate to undergo an exam if the same is required for all new employees in similar jobs. Allow medical professionals to screen a hire before they start the job to verify that they are able to perform the physical demands of the job for which they were hired. If information emerges from the screening that the candidate will not be able to perform the job duties safely, even with a reasonable accommodation, then and only then can you withdraw the offer of employment.

The examiner should be provided with a detailed job analysis in order to assess whether the candidate is capable of performing that job. The examination should be tailored to the job for which the candidate was hired. The exam should also include an initial drug screen, if your company has a drug policy in place. Once the exam is complete, the physician will either approve or disapprove the candidate for the position and should list any accommodations necessary for the candidate to meet the physical demands of the job.What is A Reasonable Accommodation? According to the EEOC, “An employer is required to make a reasonable accommodation to the known disability of a qualified applicant or employee if it would not impose undue hardship on the employer’s business”. Undue hardship means that the accommodation would be too difficult or too expensive to provide, in light of the employer’s size, financial resources and the needs of the business. An employer may not refuse to provide an accommodation just because it involves some cost, nor does an employer have to provide the exact accommodation the employee or job applicant wants. If more than one accommodation works, the employer may choose which one to provide. An employer is not required to lower production standards to make an accommodation, nor is an employer obligated to provide personal use items such as hearing aids or glasses. For additional information on this topic, you can follow the link below for guidance from the EEOC for employers on what questions can be asked and how exams can be performed. http://www.eeoc.gov/laws/types/disability.cfm Following a clear and consistent hiring process that includes a conditional offer of employment and post-offer, pre-employment exams, will help to reduce workers’ compensation premiums in the long run. If you need assistance implementing a new program, or updating your existing program, please contact your Loomis Company representative.

If you have additional questions or need assistance, please contact: Diane L. Cameron, Director of Claims Office (610)374-4040 ext. 2318 Mobile (610)413-3191

The Work Comp Insights is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice. © 2011 Zywave Inc. All rights reserved.

Promoting Safety in an Aging Workforce

The makeup of the working population is changing. This shift in worker demographic is largely due to the lack of early retirement by the baby boomer generation. Whether these workers are coming out of retirement seeking full- or part-time work or simply staying in the workforce longer, there is a great need to manage and maintain this population safely and effectively. Who is an aging worker? There is no set age that represents an older worker. An aging worker can be defined by a variety of parameters. They are full-time and part-time workers; temporary and permanent; and can be found in almost any occupation. Older workers can be 45, 65 or even in their 70s.

As 76 million baby boomers continue to grow older, they are predicted to stay in or return to the workforce. According to the U.S. Bureau of Labor Statistics (BLS), the number of workers ages 55 and older will increase to 73% by 2020, while the number of younger workers will only grow 5%. Not only that, the BLS also reports that between 1977 and 2007, the employment of workers 65 and older increased 101% while total employment only increased 59%. For men over 65, the increase was 75% and for women it was as high as 147%. And the BLS expects this growth in aging workers to continue through the next decade. Age Discrimination in Employment Act The Age Discrimination in Employment Act of 1967 (ADEA) protects individuals who are 40 years of age or older from employment discrimination based on age. This applies to both employees and job applicants. Under ADEA, it is unlawful to discriminate against a person because of his/her age with respect to any term, condition or privilege of employment. This includes the processes of hiring, firing, promotion, layoff, compensation, benefits, job assignments and training. Benefits that come with experience Many employers are wary about hiring or even maintaining an aging workforce at their organization. But there are many possible benefits. Employers must consider the full range of economic implications of an aging workforce including both cost and productivity factors. There are financial implications that suggest that aging workers can reduce costs and increase productivity at the workplace:

- Hiring or retaining older workers means enhanced skills such as experience, maturity and engagement stay in, or are added, to your organization.

- Due to turnover costs being as much as 50% of an annual salary for many positions, the benefits of maintaining a stable workforce and avoiding turnover often exceed the increased compensation and benefits costs of aging workers.

- Even though cognitive declines can occur with age, knowledge and experience in a field can offset this. Communication and decision-making skills acquired with experience at an organization can make up for a decline in manual dexterity.

- Older workers are not more likely to get injured or sick than other workers. They also have fewer avoidable absences, a lower turnover rate and fewer work-related accidents than younger workers. But in the event that they have an accident on the job, they are much more likely to have a serious injury.

Addressing safety concerns Despite older workers having a lower injury rate, the fact that their work-related injuries tend to be much more serious than those incurred by their younger co-workers is a major safety concern. Age-related changes and declines can include:

- Shorter memory

- Slower reaction time

- Decline in vision and hearing

- Poor sense of balance

- Denial of decreasing abilities

These limitations can lead to many injury types for older workers:

- Falls caused by poor balance, decline in vision, slowed reaction time or other outside distractions.

- Sprains and strains from loss of strength, endurance, flexibility and balance.

- Cardiopulmonary overexertion from extreme heat or cold, heights or confined spaces.

- Injuries incurred from repeating the same task for years. For example, machine operators who experience a loss of hearing from continued exposure to noise.

There are signs to look out for suggesting that aging workers might need some accommodations to continue to be successful on the job:

- Physical signs such as fatigue, tripping or noticeable loss of balance.

- Feedback from other employees that the worker has been declining in performance.

- Psychological or emotional signs such as irritability or loss of patience with repetitive or new tasks.

- History of minor work-related injuries or “near misses” with machinery or during other tasks.

- Developing pattern of absences or sick days.

Strategies for managing aging workers There are many ways to help keep your aging workers safe in the workplace. By taking a proactive approach and making some workplace modifications, you are a step toward ensuring the safety of all your workers. Consider addressing the challenges associated with aging workers by doing the following:

- Rotate work assignments so that aging employees have less exposure to repetitive motion risks. Rotating routines periodically can also improve employee morale by avoiding boredom.

- If possible, eliminate heavy lifts, long reaches and elevated work from ladders.

- Facility maintenance helps ensure a safe work environment. Poorly guarded machinery or other office equipment with makeshift repairs can result in injuries, especially for aging employees.

- A job safety analysis and ergonomic assessment can be used to identify possible improvements to a work environment. These tools can identify potential hazards and determine the safest way to perform a job.

- Falls alone are responsible for more than 1/3 of all injuries incurred by workers 65 and older. Because of this, prioritizing slip and fall prevention at the workplace is very important. Installing skid resistant material for flooring and stairs is a great step.

- Design work floors and platforms with smooth and solid decking that still allows for some cushioning.

- Utilize telephone equipment with the capability to adjust the volume.

- Improve lighting and color contrast around the workplace as vision is typically compromised with age.

- There is a connection between increased healing time and age, so in the event that one of your aging workers does get injured, remember that it may take the employee longer to heal than a younger worker with a similar injury.

- Encourage all employees to participate in an exercise program. This could potentially reduce the risk of experiencing an injury on the job.

- Ultimately, make safety a priority. Senior management must be visible in the safety effort and must support improvement.

The Loomis Company is here to assist you with your workers’ compensation and safety needs. For an on-site analysis and/or workplace recommendations, please contact your Loomis Company representative.

If you have additional questions or need assistance, please contact: Diane L. Cameron, Director of Claims Office (610)374-4040 ext. 2318 Mobile (610)413-3191

The Work Comp Insights is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice. © 2011 Zywave Inc. All rights reserved.

When is a Workers Compensation Claim Compensable?

Carefully evaluating workers compensation claims is crucial in helping your company save money and prevent fraud. Workers compensation is simply a form of insurance that offers employees medical coverage in the event they are injured at work or during a work-related function. It may also provide compensation for wages lost or cover rehabilitation costs so the employee can return to the workplace quickly and smoothly.

Workers compensation is crucial to protecting employees, but it is often a source of contention among employers because it comes with considerable grey areas. When is a claim compensable? How do we identify a fraudulent claim? How do we report a claim, and should we report all workplace injuries no matter how serious? This piece is designed to help you determine when – and – if an injury is covered by workers’ compensation.

Requirements

The claim must meet all five of these requirements in order to be compensable. Let’s examine each one individually:

1) Accident or Incident Occurred to One of Your Employees

The first requirement is in place to ensure it is your employee filing the claim, not an independent contractor or vendor who works for themselves or a third party. Even if the incident occurs on your property, unless it is someone who works directly for you(e.g. is on your payroll), the claim is not compensable.

2) Result in Injury or Illness

Injury is not the only thing that can potentially be covered by workers compensation. Illnesses could also qualify as a compensable claim, but only if they are directly related to the job. The illness must also be caused directly by the working conditions to be covered under a workers compensation policy. For example, a miner’s contraction of black lung would be compensable in all states. However, an employee in an office with a co-worker who smokes would not be eligible for workers compensation for treatment of illness due to second hand smoke.

3) Arise Out of Employment

This requirement means there must be a direct connection between the injury and the desire or attempt to further the employer’s business. If the employer benefits in some way, whether monetarily or otherwise, from the employee’s activity, then the claim meets this qualification.

4) Occur in the Course and Scope of Employment

The employee must be at work when the injury occurs. This includes any place or location mandated or expected by the employer. So when an injury occurs at the employee’s physical everyday work site, that employee must prove he or she was injured while actively engaging in the furtherance of the employer’s business. There is a special provision called the “coming and going rule”, which maintains that benefits are denied for injuries received when traveling to or from work. Additionally, injuries arising out of transit from one work site to another, for instance when traveling to visit clients, are compensable. This provision also requires that the actions leading to the injury of the employee in question be prompted by the aspiration to further the employer’s business interests.

5) Result in Impairment and/or Lost Wages

The injury or illness in question must cause the employee to be impaired in some way and lose wages from not being able to perform his or her tasks completely. It is also a compensable incident if the injury or illness results in the need for medical treatment without lost wages, or vice versa.

Identifying a Fraudulent Claim

According to the U.S. Business Journal, roughly 80 percent of all workers compensation claims filed are legitimate. However, it is still important as an employer to watch for these red flags that may indicate a fraudulent claim:

- Filing multiple claims.

- Longer absences than anticipated by the employee, combined with an unwillingness to return to work.

- Unwillingness to be assigned to other, lighter jobs within the company or to complete partial duties.

- Constantly missing medical appointments.

- Employee will not provide date, time or location of the incident that caused the injury.

- Lack of witnesses to an accident or incident or witness reports differ from what the employee reported.

- Employee cannot produce specific information about the nature of the injury.

- Employee has a history of work-related injuries or pre-existing medical conditions.

- Employee has a history of short-term employment.

- Employee has a history of performance issues or was recently place on warning.

- Employee reports an injury after giving notice that he/she is terminating employment or taking voluntary retirement.

If any of these red flags occur, it by no means makes the claim automatically fraudulent – these are simply guidelines to keep employers proactively evaluating the legitimacy of a workers compensation claim. Notify the claims adjuster or your Loomis Company representative if you suspect fraud or if you have further questions regarding whether or not to report a claim.

If you have additional questions or need assistance, please contact: Diane L. Cameron, Director of Claims Office (610)374-4040 ext. 2318 Mobile (610)413-3191

The Work Comp Insights is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice. © 2011 Zywave Inc. All rights reserved.

The First 24 Hours After an Injury

The moment an injury occurs, it initiates a sequence of events that can last for weeks or even months. But no matter how prolonged the recovery period, the first 24 hours after an injury are the most crucial. To respond effectively to an incident, the majority of the action items should occur within 24 hours. Your supervisors may already be experienced in handling injuries. Still, a clearly defined 24-hour injury response plan will help them provide even more effective and consistent responses, and ensure that supervisors and employees know what to expect when someone is injured. The plan will also provide the necessary guidance when experienced supervisors are not immediately available to respond to an accident or injury. The First 24 Hours after an Injury are Critical Injured employees may feel worried about keeping their jobs, worried about their health and frustrated or confused by company policies. A rapid response plan turns a potentially negative event into a more manageable scenario for you and the employee by addressing their concerns up front, helping them get the care they need and lowering claims costs. Both organizations that work with injured employees— such as the American Academy of Orthopedic Surgeons—and those that work with risk management for organizations—such as the Public Entity Risk Institute—agree that prompt and thorough action promotes the best outcomes for everyone involved. The lag between when an injury occurs and the reporting of that injury has a significant effect on both the time it takes to close the claim and the final cost of the claim. A study published by the Hartford Financial Services Group found the following: – Claims reported during the second week after an occurrence had an average settlement value that was 18 percent higher than for claims reported during the first week. – Waiting until the third or fourth week resulted in claims costs that were about 30 percent higher. – Claims that were not reported until one month after the occurrence were typically 45 percent higher. – According to the study, back injuries were particularly sensitive to delayed reporting. Waiting just one week to report a back injury typically results in a 40 percent increase in the ultimate cost of the claim. Common Reasons for Delayed Reporting

Injured employees may feel worried about keeping their jobs, worried about their health and frustrated or confused by company policies. A rapid response plan turns a potentially negative event into a more manageable scenario for you and the employee by addressing their concerns up front, helping them get the care they need and lowering claims costs. Both organizations that work with injured employees— such as the American Academy of Orthopedic Surgeons—and those that work with risk management for organizations—such as the Public Entity Risk Institute—agree that prompt and thorough action promotes the best outcomes for everyone involved. The lag between when an injury occurs and the reporting of that injury has a significant effect on both the time it takes to close the claim and the final cost of the claim. A study published by the Hartford Financial Services Group found the following: – Claims reported during the second week after an occurrence had an average settlement value that was 18 percent higher than for claims reported during the first week. – Waiting until the third or fourth week resulted in claims costs that were about 30 percent higher. – Claims that were not reported until one month after the occurrence were typically 45 percent higher. – According to the study, back injuries were particularly sensitive to delayed reporting. Waiting just one week to report a back injury typically results in a 40 percent increase in the ultimate cost of the claim. Common Reasons for Delayed Reporting The most common reason for delayed reporting is that the injured party believes the pain will go away. This creates problems, as most injuries that are not addressed immediately take longer to heal. The second most common reason for delayed reporting is a lack of employee training. Approximately 97 percent of employees injured on the job do not know what process to follow. In many cases, they will go to their own doctor rather than reporting to their supervisor. Less common, but certainly prevalent, is the concern that there will be a negative reaction from a supervisor. This highlights the importance of supervisor training, creating a clear message about immediate reporting, and maintaining a supportive work environment. Delayed reporting may also be caused by a conflict over a non-injury issue. This occasionally can result in an employee belatedly reporting a real or fabricated injury in order to retaliate for some other grievance against the company or supervisor. Unfortunately, claims of this nature are rarely resolved quickly. Training and Communication Since time is so valuable to the process, it is important that training is given in advance so employees will not be confused about their responsibilities should an injury occur. For supervisors, training allows them to take a more active role in managing the response and to serve as a guide for injured employees. This means quicker reporting times and better health outcomes. Training should ensure employees are aware of how to access appropriate care. Employees should be comfortable reporting injuries knowing they will be treated with care and respect. During training, continually reinforce the company’s commitment to helping every injured employee heal properly and return to work promptly. To aid in educating your staff about workplace injuries, your company should create and post a written, 24-hour response plan for employees and supervisors to follow. Prompt Medical Treatment

The most common reason for delayed reporting is that the injured party believes the pain will go away. This creates problems, as most injuries that are not addressed immediately take longer to heal. The second most common reason for delayed reporting is a lack of employee training. Approximately 97 percent of employees injured on the job do not know what process to follow. In many cases, they will go to their own doctor rather than reporting to their supervisor. Less common, but certainly prevalent, is the concern that there will be a negative reaction from a supervisor. This highlights the importance of supervisor training, creating a clear message about immediate reporting, and maintaining a supportive work environment. Delayed reporting may also be caused by a conflict over a non-injury issue. This occasionally can result in an employee belatedly reporting a real or fabricated injury in order to retaliate for some other grievance against the company or supervisor. Unfortunately, claims of this nature are rarely resolved quickly. Training and Communication Since time is so valuable to the process, it is important that training is given in advance so employees will not be confused about their responsibilities should an injury occur. For supervisors, training allows them to take a more active role in managing the response and to serve as a guide for injured employees. This means quicker reporting times and better health outcomes. Training should ensure employees are aware of how to access appropriate care. Employees should be comfortable reporting injuries knowing they will be treated with care and respect. During training, continually reinforce the company’s commitment to helping every injured employee heal properly and return to work promptly. To aid in educating your staff about workplace injuries, your company should create and post a written, 24-hour response plan for employees and supervisors to follow. Prompt Medical Treatment Immediate assessing of the injury and facilitating appropriate and personal treatment is crucial. Determine the type and severity of the injury. Ideally, a staff member trained in first aid can assess the severity of the injury and the appropriate action needed. For injuries that usually result in the most lost time and highest claims costs, such as sprains, strains, neck and back injuries, appropriate medical care is most likely a prompt visit to a clinic or a doctor well versed in occupational medicine. An established clinic relationship facilitates prompt and appropriate treatment for injured workers. Timely Reporting After triaging the victim and providing prompt medical attention, it’s important that the injury gets reported to the appropriate parties immediately. Ensure that injury reporting is quick across all levels (supervisor, injury management coordinator and insurance carriers). Timely reporting is one important result of effective training and results in rapid return to work and minimized indemnity claims. Expedited Return to Work From the moment an injured employee is first examined, there should be considerations made as to when he or she will be able to resume their work duties. Return to Work programs tend to result in better health outcomes and preserve many important benefits, such as health coverage, that are contingent on attendance. Return to Work programs also tend to limit claims costs to medical costs only. Whenever possible, employers should accommodate return to work restrictions in order to minimize indemnity payments, because even small indemnity payments can have an adverse effect on your mod. To facilitate your Return to Work program, you should do the following: – Communicate caring and concern as soon as possible, letting injured employees know that you care about their well-being and want them back on the job as soon as they are able. – Give the injured employee forms to take to the doctor. These forms allow the doctor to authorize return to work and note any temporary restrictions an employee may have. – Follow up with the injured employee by finding out how the doctor’s visit went. Together, you can formulate an appropriate Return to Work plan. Creating and implementing an injury response plan helps to ensure consistent and effective management of workplace injuries and ultimately reduce workers’ compensation costs. If you need help establishing a plan, or have questions regarding your existing plan, please contact your Loomis Company representatives:

Immediate assessing of the injury and facilitating appropriate and personal treatment is crucial. Determine the type and severity of the injury. Ideally, a staff member trained in first aid can assess the severity of the injury and the appropriate action needed. For injuries that usually result in the most lost time and highest claims costs, such as sprains, strains, neck and back injuries, appropriate medical care is most likely a prompt visit to a clinic or a doctor well versed in occupational medicine. An established clinic relationship facilitates prompt and appropriate treatment for injured workers. Timely Reporting After triaging the victim and providing prompt medical attention, it’s important that the injury gets reported to the appropriate parties immediately. Ensure that injury reporting is quick across all levels (supervisor, injury management coordinator and insurance carriers). Timely reporting is one important result of effective training and results in rapid return to work and minimized indemnity claims. Expedited Return to Work From the moment an injured employee is first examined, there should be considerations made as to when he or she will be able to resume their work duties. Return to Work programs tend to result in better health outcomes and preserve many important benefits, such as health coverage, that are contingent on attendance. Return to Work programs also tend to limit claims costs to medical costs only. Whenever possible, employers should accommodate return to work restrictions in order to minimize indemnity payments, because even small indemnity payments can have an adverse effect on your mod. To facilitate your Return to Work program, you should do the following: – Communicate caring and concern as soon as possible, letting injured employees know that you care about their well-being and want them back on the job as soon as they are able. – Give the injured employee forms to take to the doctor. These forms allow the doctor to authorize return to work and note any temporary restrictions an employee may have. – Follow up with the injured employee by finding out how the doctor’s visit went. Together, you can formulate an appropriate Return to Work plan. Creating and implementing an injury response plan helps to ensure consistent and effective management of workplace injuries and ultimately reduce workers’ compensation costs. If you need help establishing a plan, or have questions regarding your existing plan, please contact your Loomis Company representatives:

If you have additional questions or need assistance, please contact: Diane L. Cameron, Director of Claims Office (610)374-4040 ext. 2318 Mobile (610)413-3191

The Work Comp Insights is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional for appropriate advice. © 2011 Zywave Inc. All rights reserved.

How to Reduce Your Liability during Company Holiday Party

If you’re throwing your staff a Christmas party this year, don’t forget that holiday soirees also mean increased liability for workers’ comp, harassment and third-party injuries.

For example, did you know that if one of your staff is injured at your holiday party it could trigger a workers’ comp claim, since it could be considered “within the course and scope of employment”? Workers’ comp and employment law attorneys have different opinions about this, but the overriding consensus is that some of it could become a workers’ comp claim if:

- Attendance is mandatory, regardless of whether it’s expressed or implied.

- The party is held during working hours.

- The event is held on your premises.

- Employees are recognized with rewards, or if you give out bonuses at the event.

- The event includes vendors or customers.

The rules for this can vary depending on the state and how broadly the courts define “scope of employment.”

For example, in Minnesota three years ago, an employee had been out on medical leave for a non-work-related injury, and she went to the company’s annual dinner after she received an invitation and the promise of a turkey.

After she had collected her turkey, however, she slipped, fell and injured herself in the parking lot. The state supreme court found that the employer had directed the employee to come to the premises to obtain the turkey, which the court noted was a form of bonus compensation.

In California, all company-sponsored events fall within the course and scope of employment, because they benefit the employer by improving employee morale and furthering employer-employee relations.

But the biggest issue is liability, and a case in 2013 should make you think twice before serving alcohol – or even allowing your staff to bring their own booze. In the case of Purton vs. Marriott International, Inc., the California Supreme Court found the employer, hotel chain Marriott, liable for the actions of an employee who took his own liquor to a company party, drove home drunk and killed another motorist. The court found that as long as the proximate cause (intoxication) was within the course and scope of employment, the employer could be liable.

Here are 10 tips to help ensure that cheer does not turn into a legal nightmare:

- Attendance must be voluntary. To make sure that your employees understand this, clearly state it in the invitation and any announcements you may post about the party in your workplace.

- Hold your event after working hours and at a venue other than your office. This reduces the likelihood the party will be perceived as work related.

- Also, don’t try to coax employees to come by implying that attendance can help them advance their careers or standing in the office, or that not coming would be viewed by other staff as the employee not being a team player.

- Don’t give out awards, bonuses or any types of recognition that would indicate that they are there for business reasons.

- Strongly consider NOT inviting vendors, customers or others with whom your company conducts business.

- Tell your employees that they can bring their spouses and significant others.

- Remind employees that normal workplace standards of conduct are to be respected. Remember, when alcohol is served at parties, it may reduce inhibitions and can lead to sexual harassment or discrimination claims. If you do receive a complaint about discrimination or harassment, don’t shrug it off. Take it seriously and conduct a proper investigation and interview the employee complaining, the one who is accused and any witnesses.

- If you want to truly reduce your risk, you should limit or not serve alcohol. Whatever you do, don’t have an open bar. Close the bar at least one hour before the end of the party. Also, hire a professional bartender who knows when to cut people off. Arrange for no-cost transportation for any employee who should not drive home. If you do plan to have alcohol, also serve plenty of food.

- Tell employees not to post pictures from or comments about your company party on social media without a policy in place.

- Discuss your exposure with us to make sure that you are properly covered for any liabilities that may arise out of the function.

Call us! We are always here to help.

The Voluntary Benefits You Should Be Offering

Employers are increasingly turning to voluntary benefits and services to personalize their benefit offerings, support their employees’ overall well-being and security, and attract and retain talent.

Voluntary benefits and services offerings today tend to be geared toward baby boomers, who are a large segment of the workforce. But, as baby boomers will be retiring in increasing numbers across the next decade, expect to see voluntary benefits and services redesigned for younger generations, who are generally attracted to customized benefit packages. Nearly half of 320 large employers polled for the Towers Watson “Voluntary Benefits and Services Survey” said they expect voluntary benefits and services to become more important than ever over the next five years. The survey also found that the importance of voluntary benefits in companies’ total rewards strategy will grow 27% in the next half-decade. If you are considering starting to offer voluntary benefits, these might be a good place to start. They are the five voluntary benefits most commonly offered by employers:

1. Life Life insurance is the most popular voluntary benefit, with 94% of employers surveyed offering it. Individual life policies were some of the first voluntary products sold in the U.S. workplace. Today, 81% of individuals with life insurance have workplace coverage, while half of individuals look to their employer as the only source for coverage, according to a 2012 ING study. But despite life insurance offerings at work, industry experts say most Americans are underinsured, if they are insured at all. According to a survey by New York Life Insurance Co., Americans want their life insurance to last around 14 years beyond the breadwinner’s death, but in reality they only have enough to last three years after the breadwinner’s death. That means the payout might need to be close to 15 or 20 times the breadwinner’s salary, rather than the common rule of thumb of seven to 10 times the salary. There are various calculators online that individuals can use to test if they are well insured.

2. Vision Some 84% of employers offer vision insurance. Voluntary vision coverage is typically a popular product. Employees view a vision benefit a high-value/high-return product because you don’t have to be sick to use it and its cost is typically one-tenth that of a medical plan. It is also a product that appeals to many individuals: two-thirds of all adults report wearing some type of eyewear, on which they spend more than $15 billion each year, according to the Towers Watson survey.

3. Dental Eighty percent of employers offer dental coverage as a benefit. Diabetes, heart disease, blindness and pregnancy complications all can be affected by dental hygiene and inflate health costs overall.

4. Disability Benefits experts have long argued disability insurance is just as important as life insurance. And employers seem to agree: 80% of employers surveyed by Towers Watson offer it. According to the Social Security Administration, a staggering 30% of people will encounter a disability of three months or longer at some point during their working years.

5. Accident insurance Accident insurance is among the most prevalent voluntary benefit offerings provided by employers: 68% offer this coverage to their employees.

Accident benefits may help cover deductibles and other services standard health care coverage may not provide. Some voluntary accident benefits can be both a reimbursement and an indemnity insurance policy – expense reimbursements are paid for actual charges or up to the maximum amount stipulated in the plan.

Embedded benefits of accident coverage typically include:

- Accident medical expense

- Ambulance benefit

- Hospital confinement

- Accidental death and dismemberment

Optional benefits and riders include accident total disability, hospital intensive care, bone fracture and dislocation, and coverage for spouse and children. Other voluntary products that might be making the list in the next couple years? Towers Watson reports critical illness, identity theft and financial counseling as the top voluntary benefits to watch in the coming years.

Looking for more tailored advice?

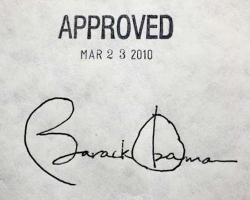

Affordable Care Act Future Uncertain

Now that we will have Donald Trump as president and the GOP retaining control of Congress, all bets

are off on the future of the Affordable Care Act. It’s likely that Trump will hand over the health insurance reform portfolio to Speaker Paul Ryan, who along with the House leadership in July published a blueprint for how they would like to repeal and replace the ACA. Trump assailed the ACA during the campaign, saying he would abolish it. But that may be easier said than done as Democrats in the Senate would certainly mount filibusters to keep some legislation from passing the upper house. And it could turn out to be extremely unpopular now that 20 million more Americans have health coverage than before the law was enacted. There’s a chance that Trump and congressional Republicans will push to end the individual and employer mandates, eliminate ACA insurance reforms such as minimum essential benefit packages, and pare back and restructure the premium subsidies. But those moves would send tremors through the market, unraveling the ACA system and could lead to millions of people losing coverage. This is what we know about the president-elect’s plans for America’s health care. He has proposed: • Getting rid of the employer mandate. • Eliminating public health insurance exchanges. • Setting up free health savings accounts for people with high-deductible insurance plans. • Setting up state-based high-risk pools for people with medical conditions that make it hard to get coverage on their own. • Allowing insurers to sell coverage across state lines to “boost competition and drive down prices.” • Eliminating the “Cadillac” tax on high-priced health plans. The House Plan The House plan includes the following: • Expanding the use of health savings accounts linked to high-deductible health plans, so that patients can direct their treatment and “shop around” for the best deal for procedures. • Supporting coverage portability, whereby individuals would purchase a health care plan that they can take with them from job to job. The plan would include a universal, advanceable and refundable tax credit for individuals and families. • Only allowing employees to pay for their premiums on a pre-tax basis up to a certain level (meaning that above a certain premium level, they would have to pay for the premium using income that’s already been taxed). • Allowing small businesses to pool together to buy health insurance, in order to garner economies of scale – and thus less expensive coverage. • Allowing consumers to buy insurance across state lines. • Preserving employee wellness programs. • To tackle costs, the plan includes reforming medical liability laws to reduce large awards for medical malpractice. The unknown The big question mark is how far the appetite will go for an outright appeal of the ACA, as it would be a major market disruption, particularly for the millions of people who now have coverage through their jobs or health insurance exchanges. Just eliminating exchanges would leave a huge hole in the market and something viable would have to replace it. Any attempts to repeal the ACA will also be met with stiff resistance from Democrats, who could mount a filibuster to keep legislation from advancing. The best strategy for our clients now is to stay the course and continuing complying with the law. No changes will be immediate and we will keep you informed of changes here as they occur.

Need More Info or Want To Learn More About Our MEC Solutions?

[button color=”#COLOR_CODE” background=”#COLOR_CODE” size=”Medium” src=”https://www.www.loomisco.com/newsletter_submit_form/”]Contact Us[/button]

New Law Tightens Workers’ Comp Exclusion for Officers, Board Members

A new law has made changes to the officer exclusion for workers’ compensation in California.

Starting in 2017, an officer can be only excluded from workers’ comp coverage if he or she owns 15% or more of the company’s stock. That’s changed from the current rules that set no ownership levels for officers and directors that want to claim a workers’ comp exclusion, which has created confusion as well as an opportunity for fraud. Current law To be eligible for a workers’ comp exclusion: • The employee must be an executive officer of the corporation (president, vice president, secretary, assistant secretary, treasurer, assistant treasurer, for example). • The employee must own some stock in the corporation. • The company must be a “closed corporation.” That means that all of the company stock must be owned by the executive officers and directors, and no one else. The election process to opt out of coverage is not very clear under current law. Beyond one limited statutory reference and very little regulatory guidance, insurers and LLCs are left to figure it out for themselves. The Association of California Insurance Companies, one of the supporters of the bill – AB 2883 – argues that this lack of clarity has led to abuses that have hurt injured workers and driven fraudulent activity. There have been cases of some companies making a janitor the “vice president of janitorial services” in order to avoid paying for their workers’ comp coverage. What’s new for 2017 AB 2883 requires: • That an officer or member of the board of directors own at least 15% of the stock of the corporation in order to opt out of workers’ compensation coverage. • That the officer or member of the board of directors sign a waiver stating that the individual is a qualifying officer or member. • That a general partner of a partnership or a managing member of a LLC execute a waiver to opt out of workers’ compensation coverage. • That with this 15% ownership requirement, there can never be more than six people excluded. • That the waiver will remain in effect until a written withdrawal is received by the insurance company, and waivers are not transferable to a new insurance company. • That grantors of revocable trusts are no longer deemed to be shareholders and will not qualify for exclusion.

Want Further Clarification or Guidance?

[button color=”#COLOR_CODE” background=”#COLOR_CODE” size=”Medium” src=”https://www.www.loomisco.com/newsletter_submit_form/”]Contact Us[/button]

Protective Safeguards Endorsement: How to Avoid Having Your Business Property Damage Claim Denied

Whether you own and insure your office or other business property, or insure the office or building you

rent, you will obviously want to make sure that you have an automatic sprinkler system or some other fire detection or suppression system in place in case of fire. You’ll also want to make sure that your fire alarms are working and that you have service contracts for periodic inspections of your facilities to identify fire and other risks. But what happens if there’s a fire in your building and your sprinkler system fails? Well, when you make your insurance claim you could be in for a nasty surprise if your policy has a “protective safeguards endorsement.” This endorsement would deny coverage if you had failed to maintain and ensure that your system is in proper working order. If your policy contains a protective safeguards endorsement, and you fail to adequately maintain any of the protective safeguards at your commercial building or manufacturing facilities and you suffer a loss caused by fire, coverage for the fire loss can be denied by your insurance company. Also, if you knowingly turn off or suspend any of the safeguards, even if it is for routine maintenance, and fail to notify the insurance company of the suspension, and a loss occurs during the suspension, coverage can be denied. Because of the potential coverage gaps that can be created by this endorsement, it’s very important for you to know whether it’s attached to your policy – and if it can be removed. If it can’t be removed, you need to understand your responsibilities in order to avoid having your claim rejected. These are types of protective safeguards that could be in the endorsement: • Automatic sprinkler system • Automatic fire alarm • Security service • Service contract • Automatic commercial cooking exhaust and extinguishing system • Any other protective system described in the endorsement schedule Protective Safeguard Horror Stories*Burmac Metal Finishing Co. – An Illinois appellate court ruled that an insurer was justified in denying coverage for a fire and explosion because Burmac had capped between three and 19 automatic sprinkler systems out of 600 at its industrial building without notifying the insurer. The court ruled that this action constituted failure to maintain the system, justifying denial of coverage. Y2K Textile, Inc. – A California appeals court ruled that an insurer had properly denied coverage for fire loss when the protective safeguards endorsement required the insured to maintain a contract with a duct-cleaning service and the insured never obtained a copy of such a contract. * Source: Faegre Baker Daniels blog Insurers will often offer a premium discount or a credit, or an otherwise uninsurable property may qualify for coverage, if the property policy includes a protective safeguards endorsement. Typically, a policy will identify the protective safeguards the endorsement covers and then it will have the following key clause: “As a condition of this insurance, you [the insured] are required to maintain the protective devices or services listed in [this endorsement].” The endorsement will spell out that the insurer will not pay for the loss or damage that is caused by or resulting from a fire if, prior to the fire, the policyholder: • Was aware that any of the protective safeguards had been suspended or were impaired prior to the fire, and that the policyholder had failed to inform the insurer. • Failed to maintain the protective safeguards in complete working order. That means that you have two duties under such an endorsement: • The duty to notify the insurer of any suspensions or impairments of any safeguards. • The duty to maintain the safeguards. Policies will also include instructions for when you must inform your insurer of a suspension of a safeguard. Most endorsements will include the following safe harbor provision: “If part of an Automatic Sprinkler System is shut off due to breakage, leakage, freezing conditions or opening of sprinkler heads, notification to us will not be necessary if you can restore full protection within 48 hours.”What you should do If you have an insurance policy for your property, and you are unsure whether it includes a protective safeguards endorsement, you can call us. If your policy does include it, we can also work with you and the insurer to see if can be removed, if you’re so inclined.

Rates Expected to Climb 4% in 2017 as Workers Grow Weary of Cost-shifting

A new survey by Mercer Human Resources has found that average premiums for group health plans should

increase by about 4% for 2017 after employers make plan changes like increasing deductibles and switching carriers. Employers have enjoyed health plan cost increases of about 4% or less each year since 2011. Prior to that, essentially before the Affordable Care Act became law, costs were increasing by double-digit percentages for many years. The new findings come after the Kaiser Family Foundation and Health Research & Educational Trust released its own employer health benefits survey, which found similar increases for this year. Premiums for single and family coverage increased on average by about 3% in 2016, an amount that is one of the lowest on record, the survey found. The average family premium, which includes the amount contributed by both the employer and the employee, was $18,142 in 2016. Individual employer coverage cost an average of $6,435 in total. The projected underlying cost growth from 2016 to 2017 is at a new low of just 5.5%, Mercer noted. That’s the increase employers would expect if they made no changes to their medical plans. The difference between the underlying cost growth and actual cost growth reflects how much employers are shifting costs via higher deductibles or out-of-pocket expenses, or reducing the value of their health plans by offering plans with narrower networkers, for example. A difference of just 1.5 percentage points for 2017 suggests employers do not plan to do much cost-shifting in 2017. For the past eight years, the difference has been approximately 3 percentage points, and has not been less than 2 points. For the most part, employers have been able to keep cost increases low by pushing plans that have higher deductibles and out-of-pocket expenses for employees. Another way that employers have been reducing their costs is to offer HMO plans with narrow hospital and doctor networks, which require enrollees to pay more out of pocket if they use providers outside the network. Are workers growing weary? But while the employers that have been pushing high-deductible plans and narrow network plans are reducing their own costs, it may be coming at a price. The Mercer survey found that many workers are starting to feel their employer-sponsored coverage has become less of a benefit and more like a way to shift out-of-pocket costs onto the backs of workers. Kaiser has reached an astounding conclusion about this. While the average worker’s earnings increased by 60% between 1999 and 2016, their premiums in employer-sponsored plans soared 240% over the same period. In addition to those premium increases, the amount they paid out of pocket for health care services also jumped to a similar degree, Kaiser found. Deductibles in employer-sponsored health plans started their steep climb in 2008, before the ACA was enacted. Between 2008 and 2016, the average annual deductible doubled to $1,478 from $735. Deductible amounts also vary depending on employer size. For example, staff in companies with fewer than 200 employees had average deductibles of $2,000 this year, Kaiser found. What employers want to see Mercer asked employers that it surveyed what they would like to see changed about the ACA: • 80% said they would like to see the excise tax (also known as the Cadillac tax) eliminated (the tax of 40% on premiums above a certain threshold has already been delayed until 2020). • 61% want to eliminate the employer mandate that requires firms with 50 or more employees to offer health coverage or pay a penalty. • 47% want to repeal and replace the ACA entirely. One bright note was that only 2% of large employers (those with 500 or more workers) and 9% of those with less than 500 would prefer to send their employees to public exchanges to buy coverage. That’s compared with 2010, when 6% of large employers and 20% of small employers said it was likely they would terminate their plans.

Looking For A Way To Manage Employee Satisfaction Without Growing Costs?

How Three Companies Reduced Their Workers’ Comp Costs

We’ve told you often in these pages about various workplace safety and claims management techniques,

but sometimes it’s good to learn from the first-hand experiences of other employers. The National Underwriter insurance trade publication recently profiled three companies that had reduced their workers’ comp costs using a combination of claims management and safety initiatives. You can use their experience to apply similar programs at your company. SMS Holdings’ experience This housekeeping and maintenance service provider did not roll out a one-size-fits-all approach to safety at is multiple locations in 46 states. The company instead took a silo approach to improving safety by having its front line staff and their supervisors come up with programs to enhance safety at each work site. It created safety committees at each of its locations that hold pre-shift safety huddles. Site managers also host weekly safety talks with employees that address hazards that are unique to the location, near misses or more general safety rules. The company also started a safety-tracking program that provides a forum for managers to exchange ideas on how injuries could have been prevented. SMS Holdings revised its injury reporting system, standardized claims instructions and forms and provided a claims checklist for its managers. Also, the company provides injured workers with a packet that outlines the process for handling their workers’ comp claim and includes all the forms and contact information they need. The company says its claims litigation rate fell to 11% of all claims in 2015, from 18% in 2014 since implementing the changes. The number of claims dropped more than 14%, and claims that required lost time from work plunged 52% – all while the payroll has increased by 14%. Seaboard Foods LLC After noting a strong uptick in claims, this self-insured pork producer started working more closely with its third-party administrator, which handles its workers’ comp claims, to mine the company’s injury claims for data. Seaboard, a 5,000-employee company in a small Texas town with a local network of providers, doesn’t always include the required specialist. The company now ensures that every injured worker receives the appropriate specialized medical care right at the time of injury, even if that means that the employee see a specialist in another town. They can drive themselves and get reimbursed for mileage, but if they can’t, then the company arranges transportation. Seaboard also started looking for and contracting with new service providers – like physical therapy and pharmacy management firms – that could demonstrate through data how they are able to reduce costs. Finally, the company started holding quarterly meetings with its senior leadership, workers’ comp team, third-party administrator and workers’ compensation attorney to review claims. They set goals and objectives for closing claims as early as possible and identifying particular claims that the company would try to close prior to the next quarter. To address injuries sustained in the cutting and packing lines, the company started conducting job-demand analyses to identify how employees get hurt doing certain tasks, and then evaluating workers to make sure they are fit for the work they’ve been assigned. Finally, it started a “work conditioning program” that helps workers get their bodies in shape to deal with the physical demands of repetitive motions they encounter in the workplace. All of this has paid off, and between 2012 and 2015 reduced Seaboard’s annual claims numbers by 46%. In addition, claims costs dropped 69% in that period. Stater Bros. Markets This supermarket chain started a new program focused on education and injury prevention for all of its employees, be they cashiers at its 168 stores or workers at its 2-million acre warehouse and distribution center in San Bernardino, Calif. Some changes were small, like requiring all employees who use knives to wear a chain-link metal mesh glove on the hand opposite the one wielding the knife. This reduced cutting injuries from an average of 200 a year to none. The company reviewed all of the clinics its injured workers are sent to, identifying and selecting facilities based on level of customer service and cleanliness. The company also started a training regimen that rotates from store to store to train staff and low-level managers on injury prevention, focusing mainly on avoiding sprains and strains – the most common injuries in its stores. For its warehouse employees, Stater introduced a program called “Ice Pack” in which physical therapists are available onsite at its corporate campus to help employees with taping, wrapping and icing parts of the body to help them do their jobs more efficiently or recover after a shift. Finally, to address rising prescription drug expenses, it conducted a claims review to identify problematic prescription patterns. It met with the health care providers its employees use and worked with pain-management doctors to find alternatives to prescribing so many drugs, which employees often are not taking. Since it started this program, Stater has reduced its prescription drug costs by $1 million over two years. Find a plan that meets your budget You can use Medicare’s plan-finder tool at Medicare.gov to evaluate the plans available to you. Here are the areas you should consider when looking for a plan that you can afford: • The cost of the premium. • What are the co-pays, and which drugs are covered – and at what cost. • Find a plan that includes your preferred doctors and pharmacy. If you find that your current coverage still meets your needs, then you’re done. If not, you’ll need to evaluate which one you can afford while ensuring it meets your needs. Medicare or Medicare Advantage? If you collect benefits from Social Security, you will automatically get Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance). Remember: There is a premium for Part B. If you are covered through active employment or by your spouse’s insurance, you must follow the directions when you get your Medicare card indicating you don’t want it. If you are going with original Medicare, you have the option of adding Part D prescription drug coverage, which will better control your medicine expenses. Or choose a Medicare Advantage (Medicare Part C) plan that bundles original Medicare with extra benefits and may include prescription drug coverage in one plan. Medicare Advantage is akin to an HMO or PPO and you will have to see doctors that are in the insurer’s network or pay higher co-pays if you go outside the network. Understand deadlines If you miss the enrollment deadline, you may have to wait until next year before you make changes. However, there is a second enrollment period – from Jan. 1 to Feb. 14, 2017 – during which you can drop a Medicare Advantage plan and switch to original Medicare. If you do, you can also sign up for Part D prescription drug coverage.

Get In Touch With Our In-House Risk Management And Claims Division To Analyze Your Current Solutions

The New Threat to Your Officers and Directors: Cyber

The top brass at companies are increasingly being held accountable by partners and shareholders for